Let’s get one thing straight: this is not financial advice. If you take this article, march to your broker, and punt your life savings on a bipedal robot startup, that’s entirely on you. What follows is a brutally honest survey of the humanoid robotics landscape as we stride into 2026, based on publicly available data. This sector is a veritable minefield of spectacular promises and crushing realities. It’s a place where fortunes could be made, but equally, where capital might go to die a fiery, hypothermic death. Proceed with caution, dear reader.

The hype, for once, might actually have some genuine substance. Analysts at Goldman Sachs have dramatically revised their forecasts, now calling for a whopping $38 billion humanoid robot market by 2035 – a six-fold increase from their previous, rather modest, estimates. The reason? AI is finally getting smart enough to make these machines genuinely useful, and the convergence of demographic cliffs, chronic labour shortages, and a geopolitical scramble to re-shore manufacturing has created a perfect storm for automation. In 2026, the dream of science fiction is no longer just a pleasant fantasy; it’s colliding head-on with the hard reality of economics.

The Macro Tailwinds: Why Now?

Three powerful forces are dragging humanoid robots from the sterile confines of the lab into the messy, unstructured real world. First up, the demographic cliff. The United States faces a manufacturing labour shortfall of nearly 2 million workers by 2033, and the situation is even more dire in Japan and Germany. The question for businesses is no longer “Is a robot cheaper than a human?” but rather, “Can I get a robot to do the job that I simply cannot find a human for?” It’s a pragmatic pivot, if ever there was one.

Second is the dawn of “Physical AI.” While generative AI like ChatGPT learned to master language with dazzling proficiency, Physical AI is about teaching machines to perceive, reason, and act with genuine efficacy in the chaotic physical world. Companies like Nvidia are busy building the foundational models—such as Project GR00T—and the silicon brains (Jetson Thor) to make this happen, essentially turning every robot into a relentless, autonomous learning machine.

Finally, we have the great supply chain reshuffling. The geopolitical friction between the US and China is forcing Western nations to bring manufacturing home. But building state-of-the-art factories in Arizona instead of Shenzhen is only cost-competitive with extreme automation. These new “lights-out” facilities, where humans are a rare sight, are being designed around robots from day one, like a meticulously choreographed ballet of steel and silicon.

The ETF Gauntlet: Your Easiest Way In (and Out)

For most investors, buying individual robotics stocks is a high-stakes gamble, a bit like playing robot roulette. A savvier approach is through Exchange Traded Funds (ETFs), which offer diversified exposure to the entire sector. But, much like droids themselves, not all robot ETFs are created equal.

The New Specialists: Humanoid-Focused Funds

In 2025, a new breed of ETF emerged, focusing exclusively on the humanoid theme. These are your sharpest tools for the job, tailored for the discerning robot enthusiast.

- Roundhill Humanoid Robotics ETF (HUMN): An actively managed fund that makes concentrated bets on companies it believes are leading the humanoid race. Its top holdings are a veritable who’s who of the sector, including UBTECH, Tesla, XPeng, and Nvidia.

- KraneShares Global Humanoid and Embodied Intelligence ETF (KOID): This fund takes a broader “ecosystem” approach. It invests not just in the robot makers themselves, but in the entire sprawling supply chain—the companies making the sensors, actuators, and chips that form the robot’s very body and brain. It has a heavier global focus, with significant holdings in Asia and Europe, offering a truly international flavour.

The Old Guard: Broad Robotics & AI Funds

These are the established players, offering a wider, if less targeted, approach to automation. Think of them as the reliable workhorses of the robotics investment stable.

- Global X Robotics & AI ETF (BOTZ): One of the largest and most popular robotics ETFs. It’s heavily weighted toward large-cap winners, meaning Nvidia often makes up a significant chunk of the portfolio. This makes it as much a bet on the broader AI trend as it is on industrial automation, a two-for-one deal for the tech-savvy investor.

- ROBO Global Robotics & Automation ETF (ROBO): This fund is far more diversified, using a modified equal-weight strategy across dozens of stocks. This shrewd approach reduces single-stock risk and gives investors purer exposure to the “long tail” of the robotics supply chain, from intricate machine vision systems to precision components – a truly comprehensive smorgasbord of robot parts.

The Public Titans and Crossover Plays

If you insist on picking individual stocks, a few giants cast a long, imposing shadow over the entire field. But the most interesting action, the real “spot on” stuff, is coming from companies you might not traditionally think of as robot makers.

The Obvious Bets

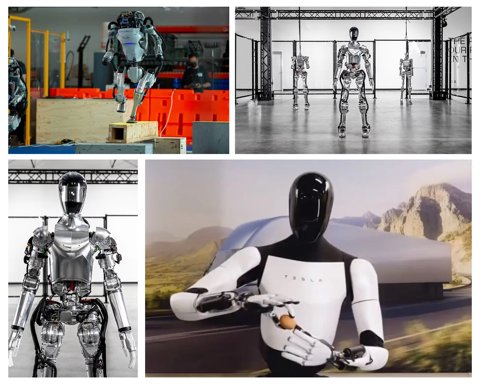

Tesla (TSLA) is arguably the largest robotics play on the public market, with Elon Musk grandly claiming the Optimus humanoid robot will eventually be more valuable than the car business. While still in its early stages, Optimus is already being deployed in Tesla’s own factories, a real-world stress test, with mass production slated to begin in late 2026. Alongside it stands Nvidia (NVDA), the ultimate “picks and shovels” investment. Nearly every serious robotics company, including Figure AI, Agility Robotics, and Boston Dynamics, is building on Nvidia’s AI platform – they’re the silent, powerful engine behind the robot revolution.

Automakers Turned Roboteers

The lines, it seems, are blurring faster than a robot performing a speed test. Electric vehicle makers are cleverly leveraging their expertise in batteries, motors, and autonomous software to build humanoids. China’s XPeng (XPEV) has explicitly rebranded as a “global embodied intelligence company,” deploying its “Iron” robot in factories with impressive agility. Similarly, Xiaomi (1810.HK) is seamlessly integrating its CyberOne humanoid into its ambitious “Human x Car x Home” ecosystem strategy, creating a connected, automated future.

The Private Unicorns and the IPO Pipeline

Here’s the frustrating truth, a real sticking point for many: many of the most exciting names in robotics are still firmly in private hands. Figure AI, backed by the likes of OpenAI, Microsoft, and Nvidia, is undoubtedly the Silicon Valley darling, the one everyone’s whispering about. Agility Robotics, maker of the Digit warehouse robot, boasts the powerful backing of Amazon. And the legendary Boston Dynamics, famed for its viral videos of agile robots, is now majority-owned by South Korea’s Hyundai Motor.

For now, direct investment is largely out of reach for most mere mortals. The only way to get exposure is indirectly, by owning shares in their corporate parents or key partners. Keep a close watch on the Hong Kong stock exchange, however. It has become a hotbed for robotics IPOs, with companies like Horizon Robotics and UBTECH already listed, and more are expected to follow in 2026, offering a potential gateway to these coveted private gems.

Risks and Red Flags: The Overcapacity Warning

Before you get too chuffed, let’s have a frank chat about the inherent risks. The primary one, the elephant in the server room, is the AI valuation bubble. Many of these stocks are priced for a perfection that may, quite frankly, take years to materialise. It’s a big ask.

The more immediate concern, however, comes straight from China. In late 2025, the country’s National Development and Reform Commission (NDRC) issued a rare public warning about “blind expansion” and “overcapacity” in the humanoid robot industry. With over 150 companies rushing into the space, there’s a serious risk of a destructive price war, a brutal race to the bottom, similar to what happened in the solar panel and EV industries. This makes careful stock selection absolutely critical. The ultimate winners will be those with a genuine software and AI advantage, not just another shiny hardware prototype.

Your Strategic Blueprint for 2026

Navigating the robotics revolution requires a finely tuned strategy, much like programming a complex machine. For most, a core holding in a diversified ETF like ROBO or KOID makes eminent sense. This gives you broad exposure to the industry’s “beta” without the crippling risk of a single company flaming out spectacularly.

Around this robust core, you can build satellite positions in “quality” leaders with proven moats, like surgical robotics giant Intuitive Surgical (ISRG) or factory automation sensor king Keyence. Finally, a smaller, more speculative allocation can be made to the high-growth, high-risk players like Tesla or Symbotic, for those with a stronger stomach for volatility.

The robot uprising won’t be televised; it will be deployed, factory by factory, warehouse by warehouse. For investors in 2026, the challenge isn’t just picking the winners—it’s surviving the hype and separating the future game-changers from the mere flashes in the pan. Good luck, and may your portfolio be ever-optimised.